Are Your SRS Savings Sitting Idle and Losing Value against Inflation?

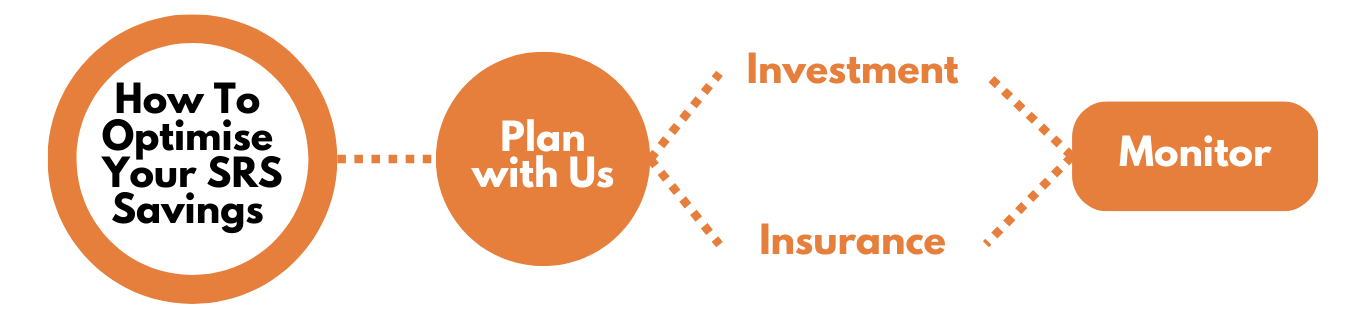

Optimise your SRS savings through long term investments to maximize returns for your retirement needs.

Optimise your SRS savings through long term investments to maximize returns for your retirement needs.

SRS is a voluntary scheme to encourage individuals to save for retirement, over and above their CPF savings.

SRS contributions are made over and above CPF contributions, and enjoy tax relief as well.

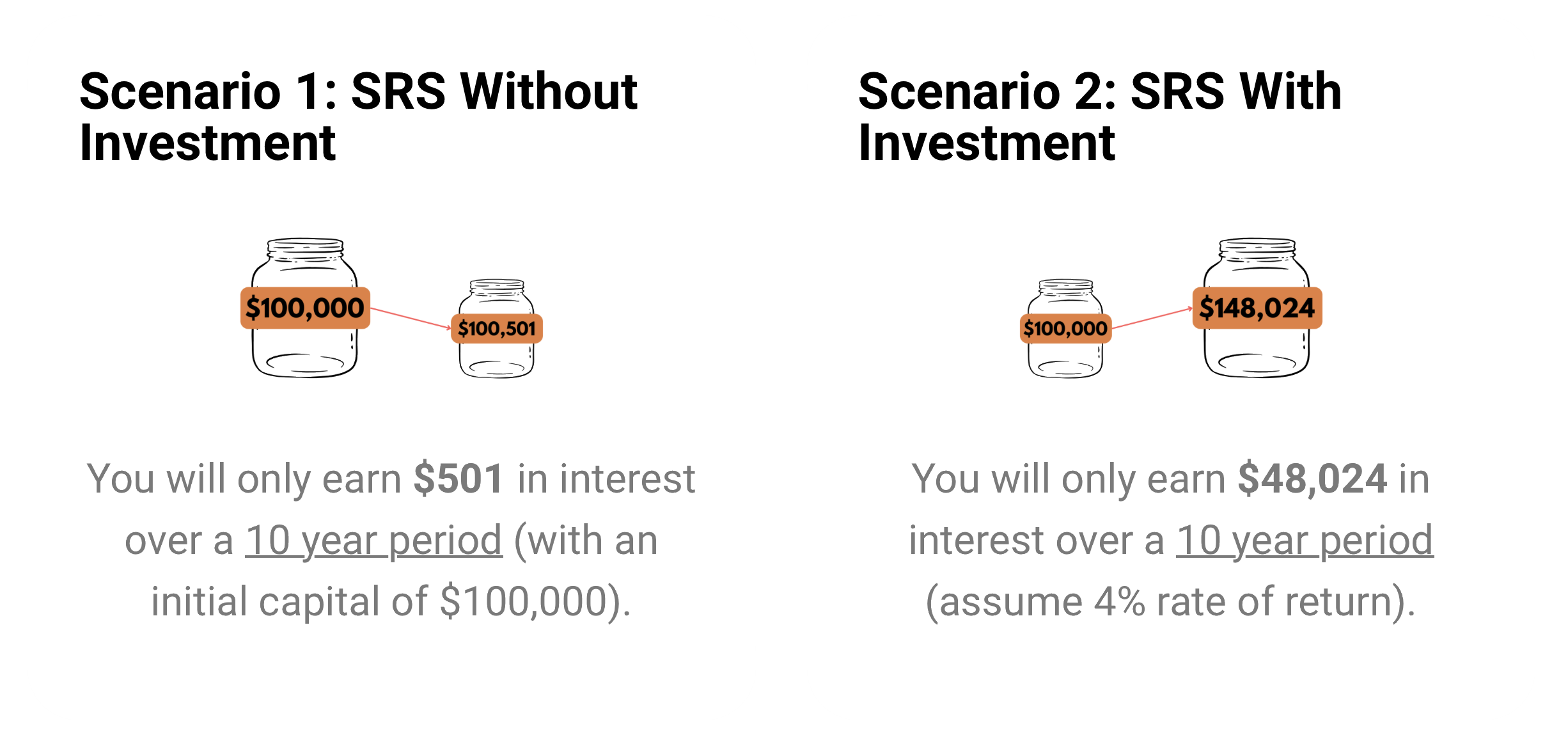

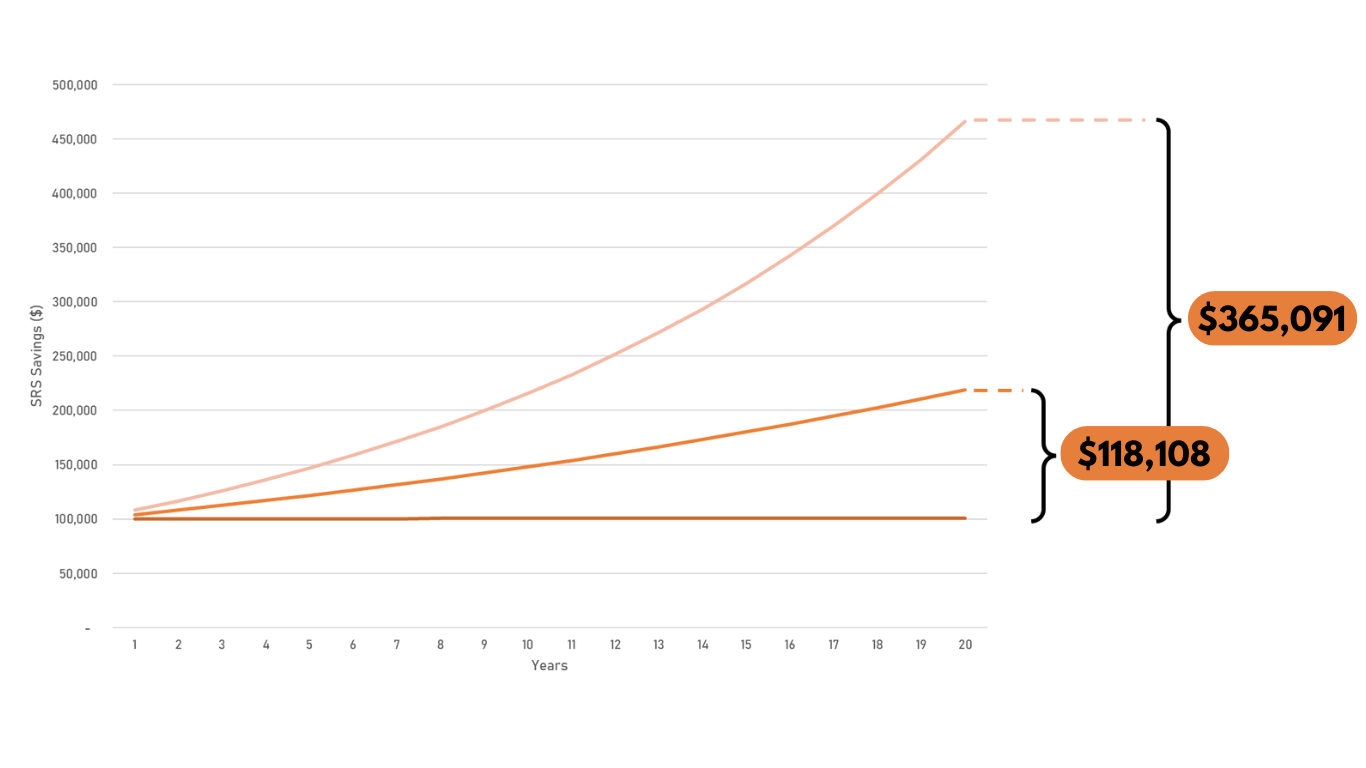

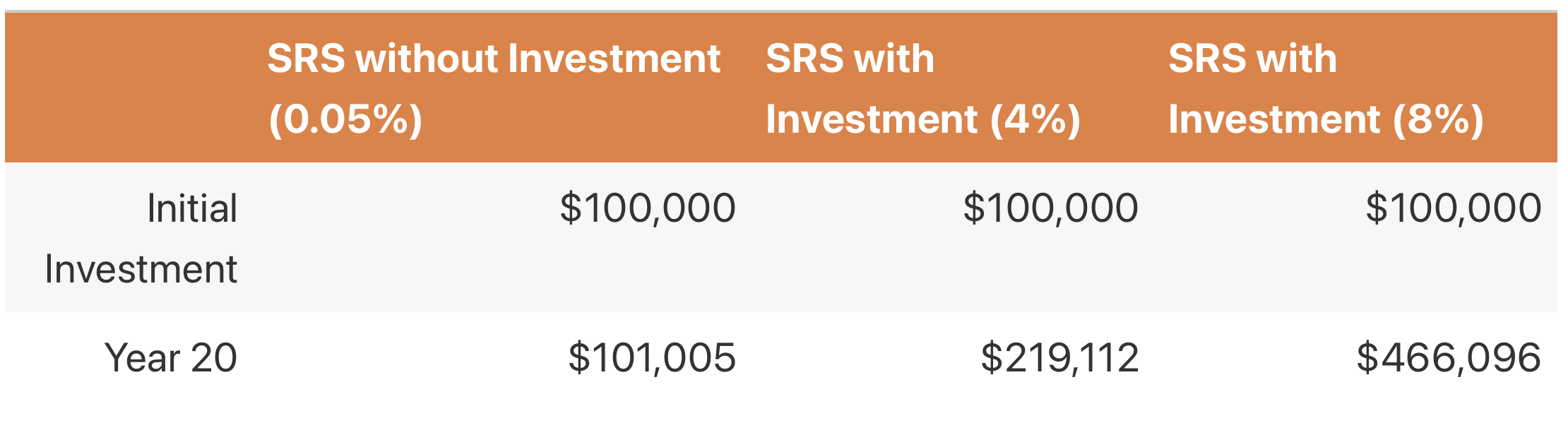

You can grow your SRS funds exponentially through long term investments, which could better increase your investment value to give you a more comfortable retirement.

But are Your SRS Savings Sitting Idle?

Are you losing out on opportunity cost?

By saving your hard-earned money in SRS without investing, you may potentially lose out $365,091 over the long run. Talk to your consultant to customize an SRS plan for you.

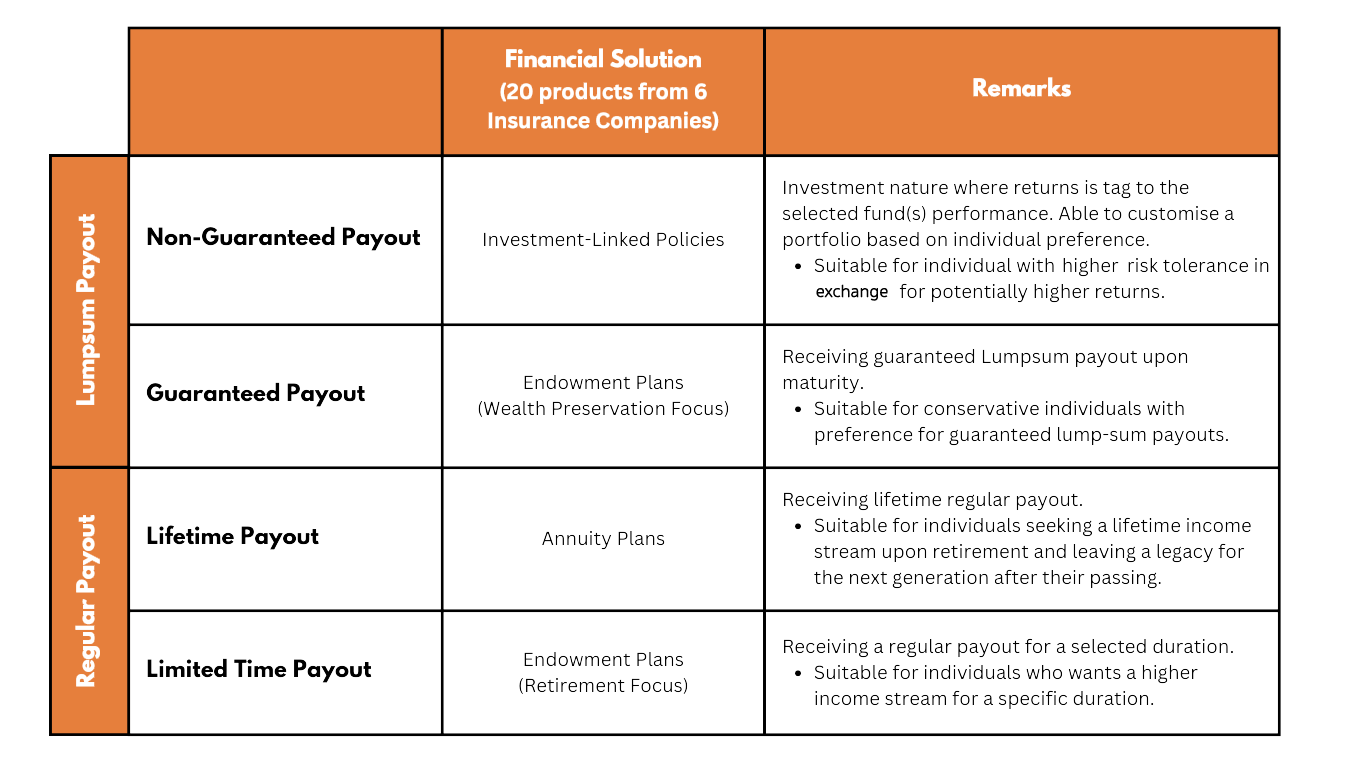

Depending on your objectives, there are multiple financial solutions to invest your SRS savings

20 approved products from 6 insurers

We have more than 1400 solutions, to suit your every needs

With over hundreds of financial solutions from 70 asset management companies and 6 insurance companies, we can help you to narrow down the options and optimise your SRS savings to suit your needs best.

(All information on investment and insurance products are correct as of 1 October 2023.)

我是专业的风险管理顾问,专注于企业和个人的风险保障。作为一名新加坡的财务顾问,我致力于帮助客户识别潜在风险,制定全面的解决方案,确保他们能够在面对不可预见的挑战时从容应对。

在企业方面,我协助公司分析和评估经营中的潜在风险,包括责任保险、关键人物保险以及业务延续规划等,帮助企业在保护核心资产的同时提升抗风险能力。在个人方面,我为客户量身定制保障方案,例如医疗保险、收入保障和退休规划,确保客户及其家人的未来得到充分保障。

我的服务以客户利益为核心,不受特定产品或机构的限制。这种中立性使我能够灵活地为客户甄选最适合的解决方案。我与多个值得信赖的合作伙伴,包括保险公司和金融机构,保持紧密合作,以确保为客户提供全面和高效的服务。

我的服务理念建立在“可靠性、责任感和关怀”之上。我注重倾听客户的需求,深刻理解他们的目标和挑战,以便提供切实可行的建议。我始终关注市场动态和政策变化,确保我的解决方案既具前瞻性又符合实际需求。

无论您是企业主,希望通过完善的风险管理保护公司发展,还是个人,希望为自己和家人提供安心的保障,我都将为您提供专业支持和个性化服务。让我们携手合作,共同规划一个稳健、无忧的未来!

I am a risk management professional specializing in company and personal risk protection. As a financial advisor based in Singapore, my primary focus is on safeguarding the interests of businesses and individuals against unforeseen risks, ensuring they are prepared for any eventuality.

In the corporate realm, I help businesses identify potential vulnerabilities and develop comprehensive risk protection strategies. This includes areas such as liability coverage, keyman insurance, and business continuity planning. For individuals, I provide tailored advice on securing personal and family well-being through solutions like health insurance, income protection, and retirement planning.

I work with a wide network of trusted partners, including insurers and financial institutions, to offer bespoke solutions that align with your unique needs and goals.

My approach is rooted in reliability, responsibility, and care. I believe in building long-term relationships with my clients by understanding their circumstances and aspirations. By staying updated on market trends and regulatory changes, I ensure the advice I provide is timely and relevant.

Whether you’re a business owner looking to safeguard your company or an individual seeking to protect your loved ones, my goal is to provide clarity, confidence, and peace of mind through well-rounded risk management strategies. Let’s work together to secure a future free from unnecessary uncertainties.

Let us assist you with all the calculations. Ride on an exciting investment journey with us!

Singapore's most progressive financial advisory firm with more than 20 years of excellence.

Financial Alliance is a leader in providing wealth advisory services to individuals and corporates alike, including private wealth advisory, Islamic wealth advisory and fee-based advisory.

We have been practising as Singapore's leading financial advisory firm for more than two decades.

Learn MoreWe work with dozens of product providers so our consultants can bring the most comprehensive solutions to clients.

Learn MoreWe are fully MAS-regulated so you always have peace of mind. Our track record speaks for itself.

Learn MoreBy definition, a FA firm is one that sells the products from more than one insurer or business partner.

However, you should consider whether the FA firm can ensure that financial advice given is free from the undue financial influence.

Ever since our founding more than two decades ago, Financial Alliance is committed to offer impartial and client-centric financial advice.

We have your best interest at heart and will leave you to make your decision.

If suitable and impartial financial advice is what you seek, then you should only engage a trusted FA firm.

At Financial Alliance, we are dedicated to offering our clients the best financial advice.