Are Your SRS Savings Sitting Idle and Losing Value against Inflation?

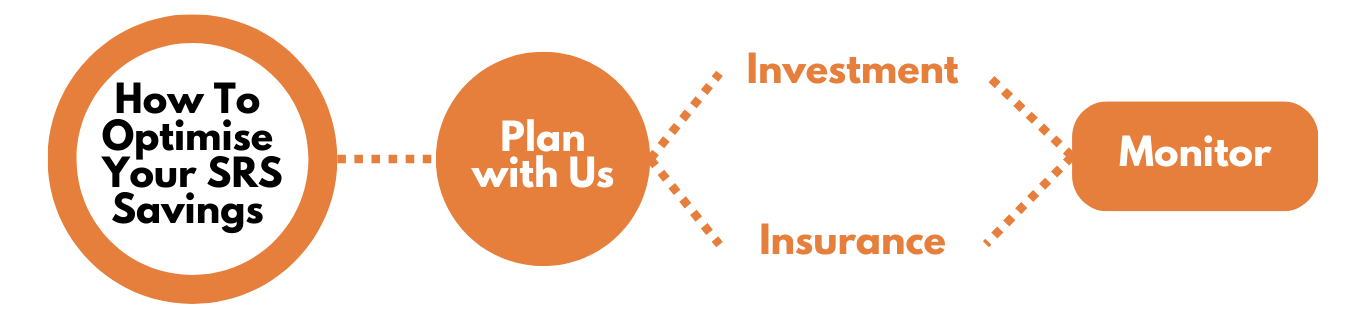

Optimise your SRS savings through long term investments to maximize returns for your retirement needs.

Optimise your SRS savings through long term investments to maximize returns for your retirement needs.

SRS is a voluntary scheme to encourage individuals to save for retirement, over and above their CPF savings.

SRS contributions are made over and above CPF contributions, and enjoy tax relief as well.

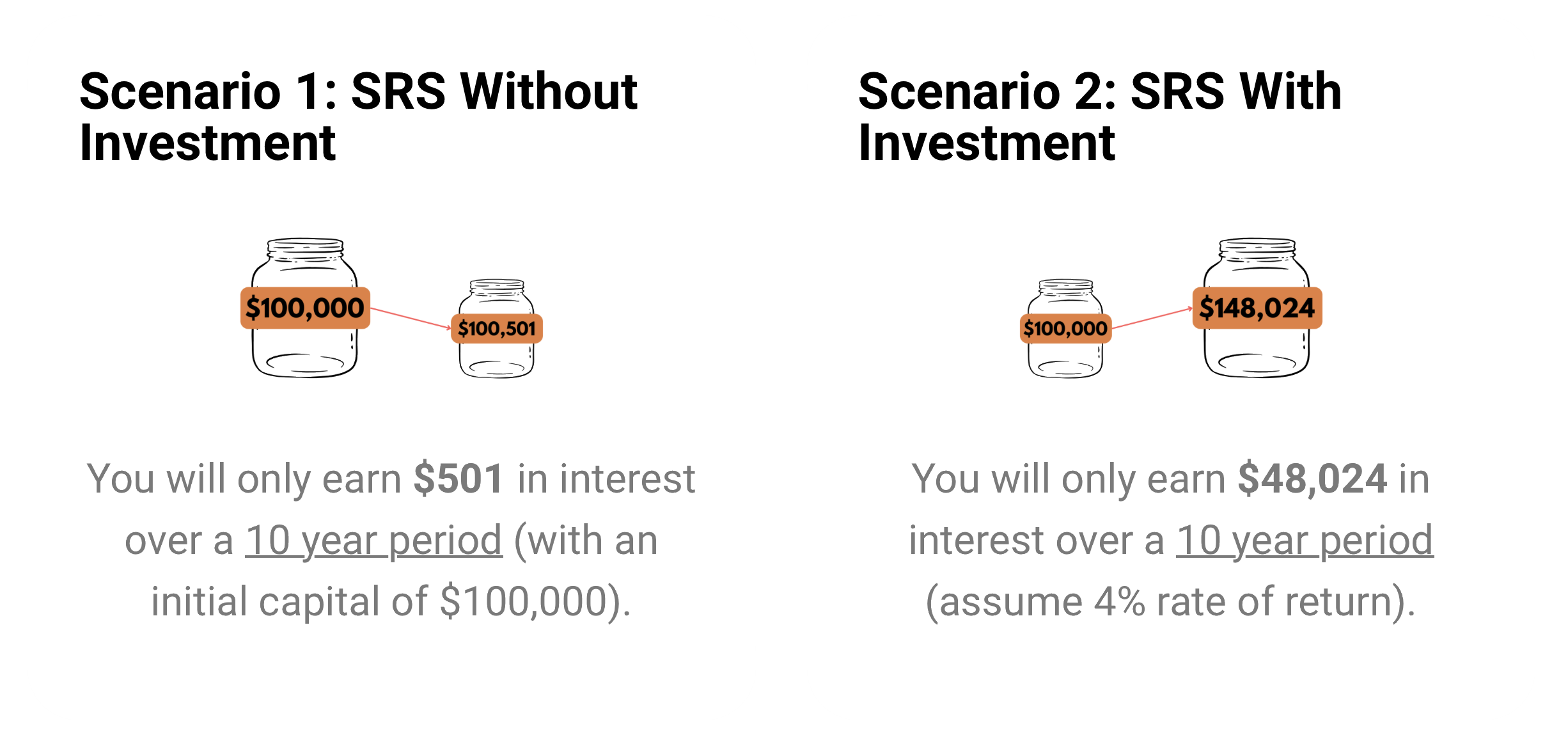

You can grow your SRS funds exponentially through long term investments, which could better increase your investment value to give you a more comfortable retirement.

But are Your SRS Savings Sitting Idle?

Are you losing out on opportunity cost?

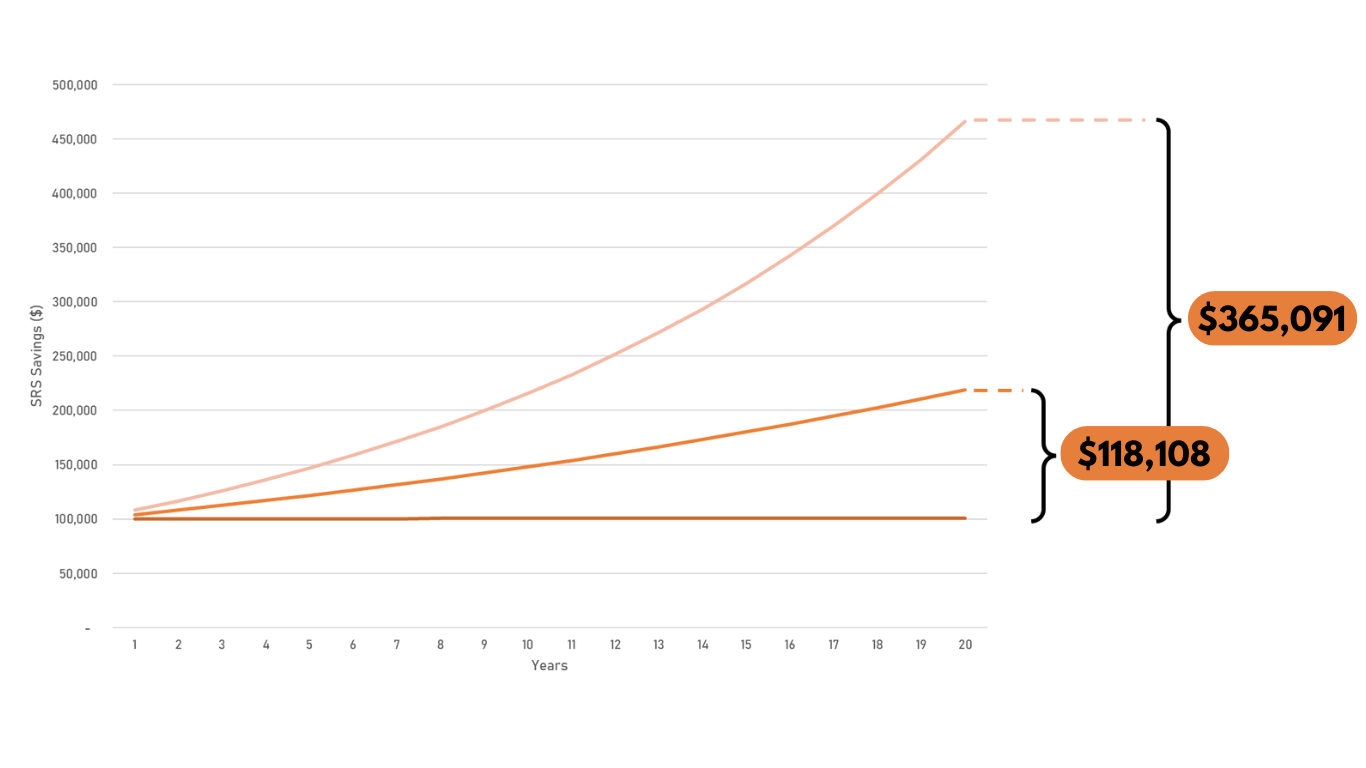

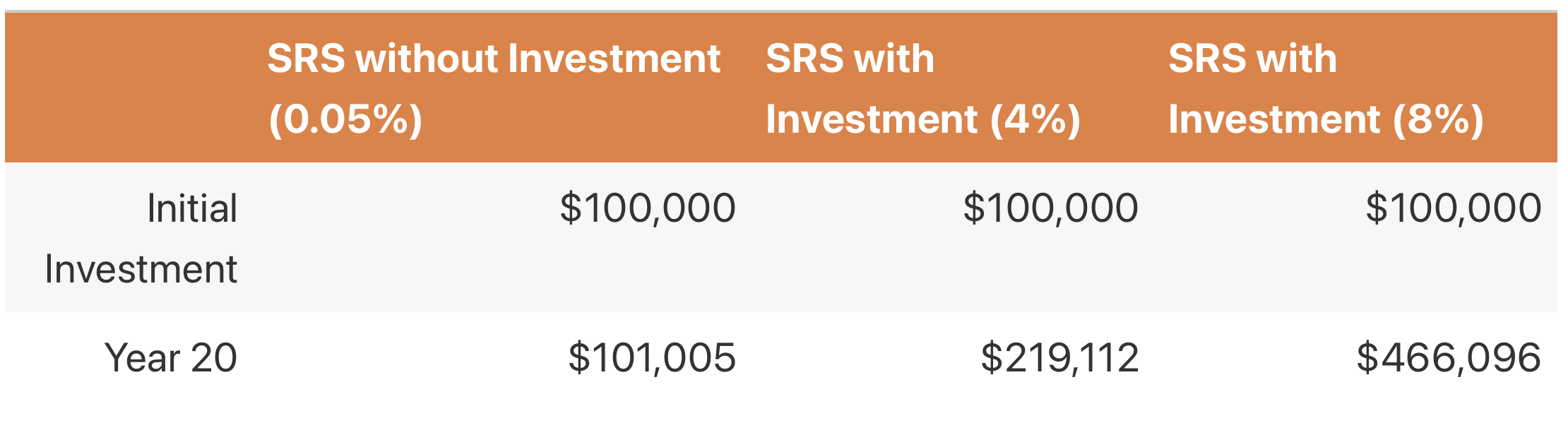

By saving your hard-earned money in SRS without investing, you may potentially lose out $365,091 over the long run. Talk to your consultant to customize an SRS plan for you.

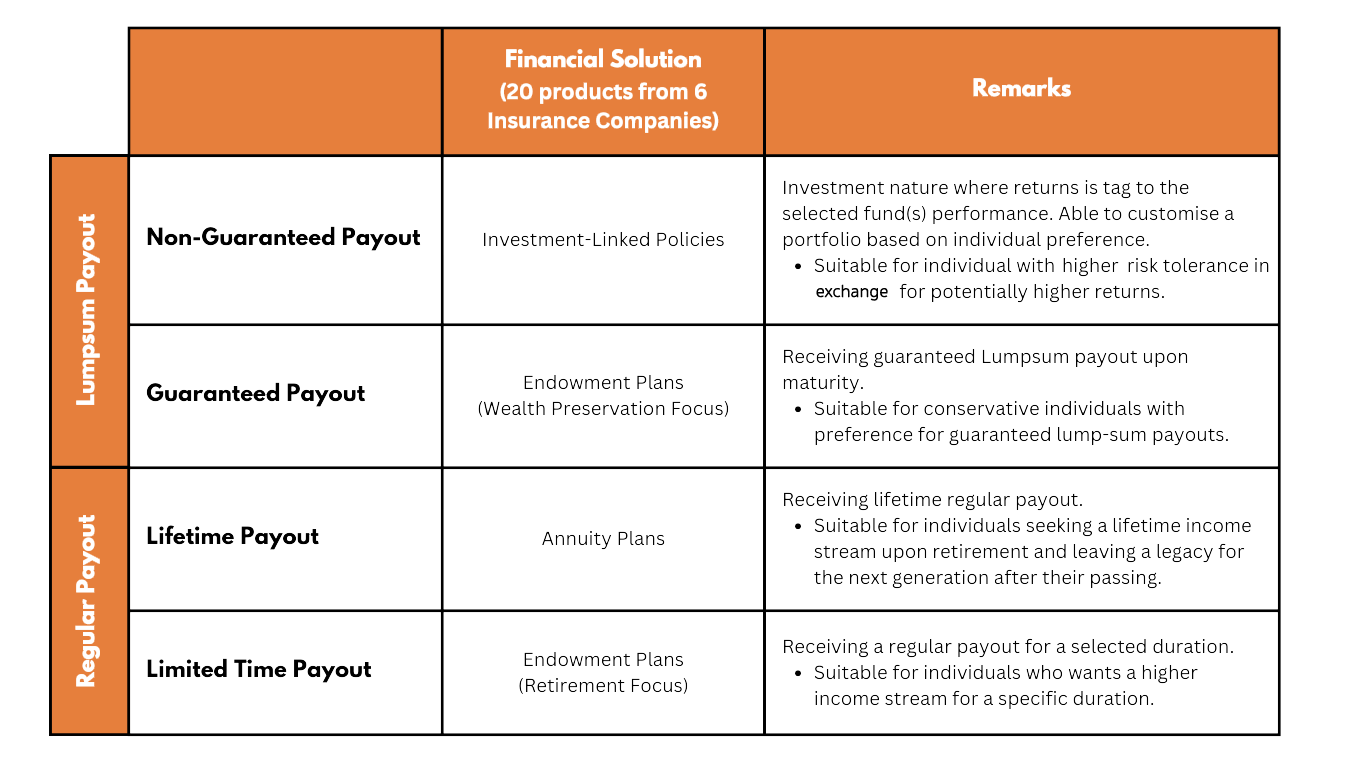

Depending on your objectives, there are multiple financial solutions to invest your SRS savings

20 approved products from 6 insurers

We have more than 1400 solutions, to suit your every needs

With over hundreds of financial solutions from 70 asset management companies and 6 insurance companies, we can help you to narrow down the options and optimise your SRS savings to suit your needs best.

(All information on investment and insurance products are correct as of 1 October 2023.)

歡迎來到我的個人網站,我是Martin乙未,土生土長的台灣人。曾經在澳大利亞和上海求學,目前定居於新加坡。

從小便對財務與投資充滿興趣,尤其是在家庭的熏陶下,這股熱情愈加濃烈。13歲時,便在金融海嘯中擁有了人生的第一張股票,也由此踏上了投資之路。在30歲之前,我成功累積了自己的第一桶金。

目前,我在新加坡最大的優質理財顧問公司工作,專注於為客戶提供資產增值和風險管理的專業服務,協助他們在多變的市場環境中穩健成長。

希望未來可以成為您在新加坡,投資理財的資源人士。

持續不斷為您輸出有價值的訊息,成為您在新加坡值得信賴的理財顧問。

Let us assist you with all the calculations. Ride on an exciting investment journey with us!

Singapore's most progressive financial advisory firm with more than 20 years of excellence.

Financial Alliance is a leader in providing wealth advisory services to individuals and corporates alike, including private wealth advisory, Islamic wealth advisory and fee-based advisory.

We have been practising as Singapore's leading financial advisory firm for more than two decades.

Learn MoreWe work with dozens of product providers so our consultants can bring the most comprehensive solutions to clients.

Learn MoreWe are fully MAS-regulated so you always have peace of mind. Our track record speaks for itself.

Learn MoreBy definition, a FA firm is one that sells the products from more than one insurer or business partner.

However, you should consider whether the FA firm can ensure that financial advice given is free from the undue financial influence.

Ever since our founding more than two decades ago, Financial Alliance is committed to offer impartial and client-centric financial advice.

We have your best interest at heart and will leave you to make your decision.

If suitable and impartial financial advice is what you seek, then you should only engage a trusted FA firm.

At Financial Alliance, we are dedicated to offering our clients the best financial advice.