Are Your SRS Savings Sitting Idle and Losing Value against Inflation?

Optimise your SRS savings through long term investments to maximize returns for your retirement needs.

Optimise your SRS savings through long term investments to maximize returns for your retirement needs.

SRS is a voluntary scheme to encourage individuals to save for retirement, over and above their CPF savings.

SRS contributions are made over and above CPF contributions, and enjoy tax relief as well.

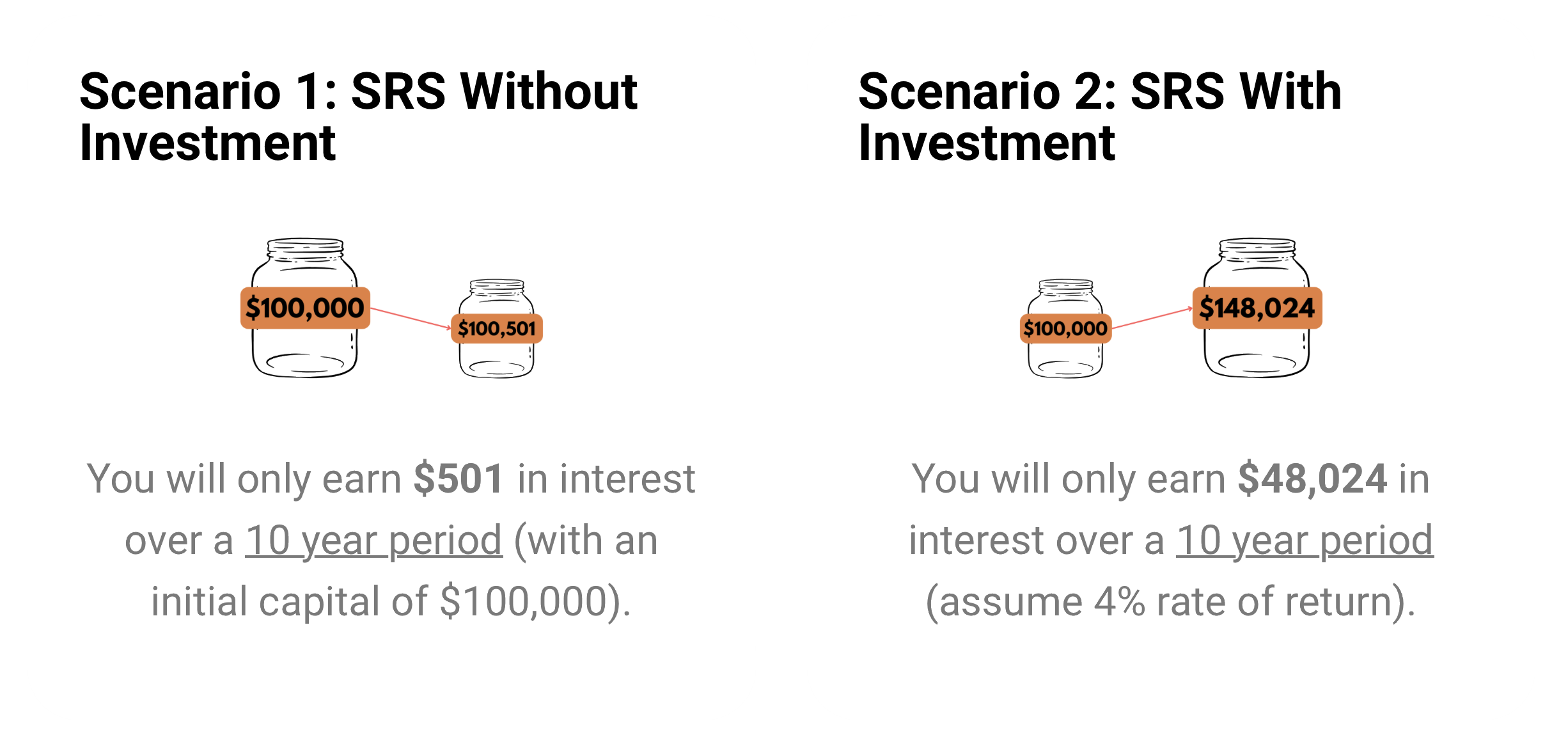

You can grow your SRS funds exponentially through long term investments, which could better increase your investment value to give you a more comfortable retirement.

But are Your SRS Savings Sitting Idle?

Are you losing out on opportunity cost?

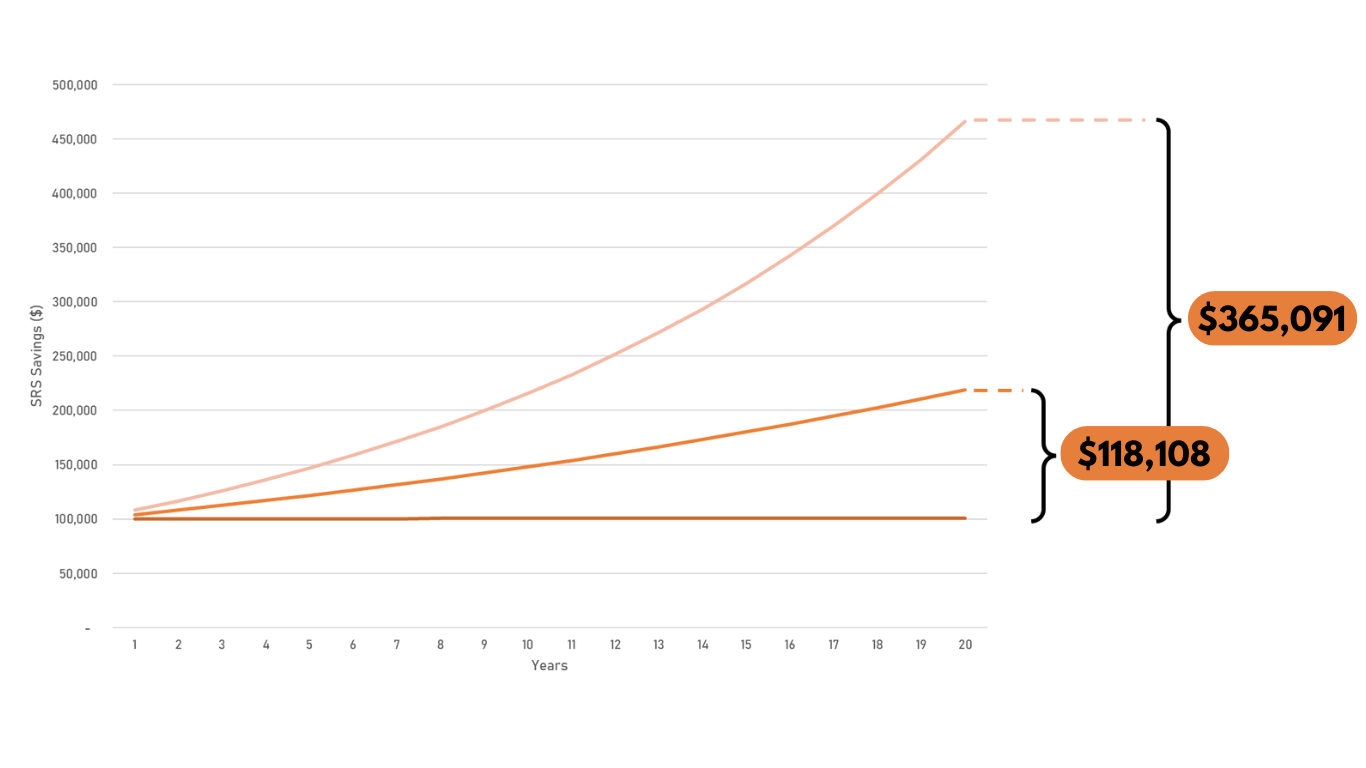

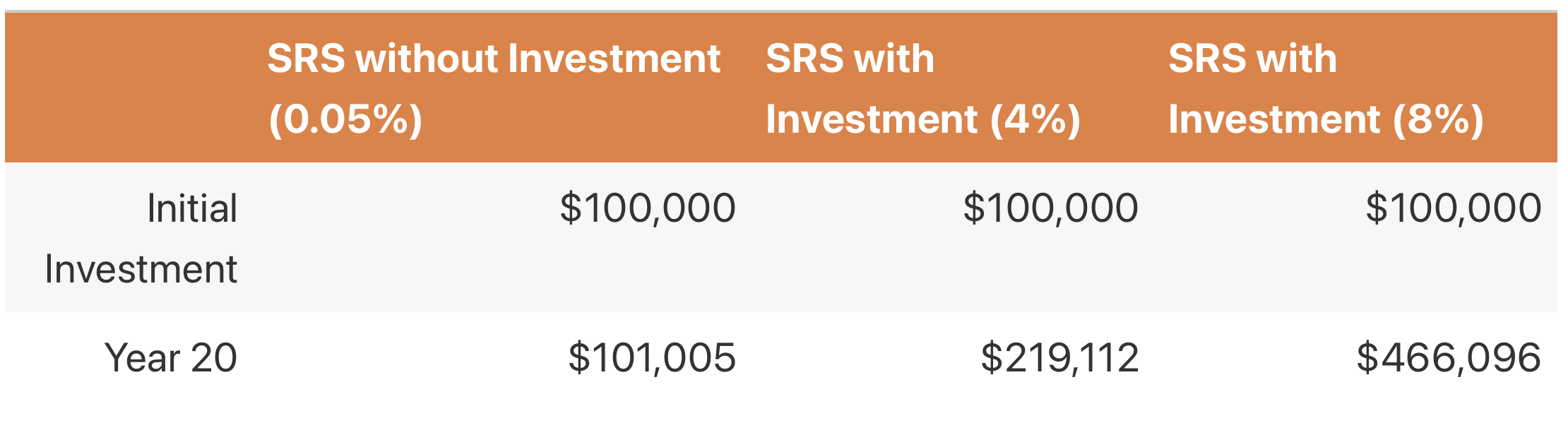

By saving your hard-earned money in SRS without investing, you may potentially lose out $365,091 over the long run. Talk to your consultant to customize an SRS plan for you.

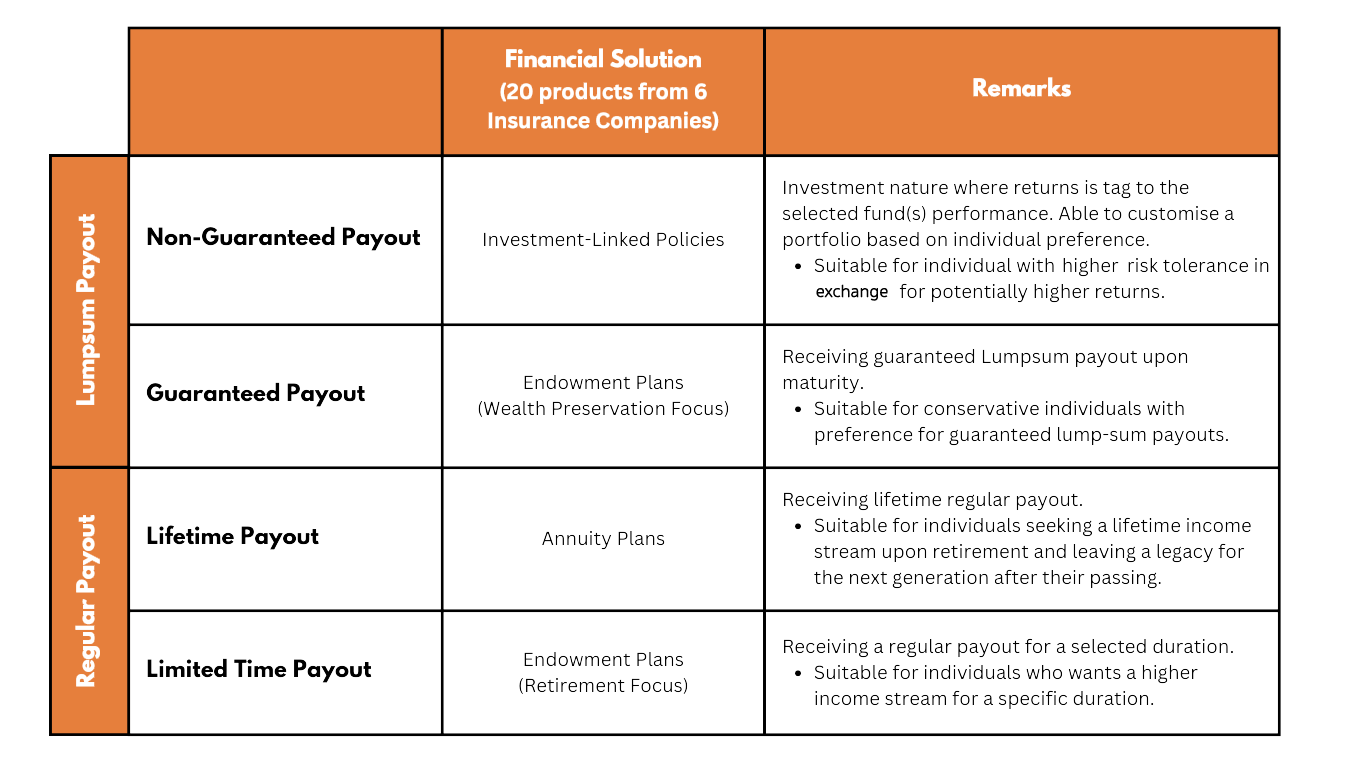

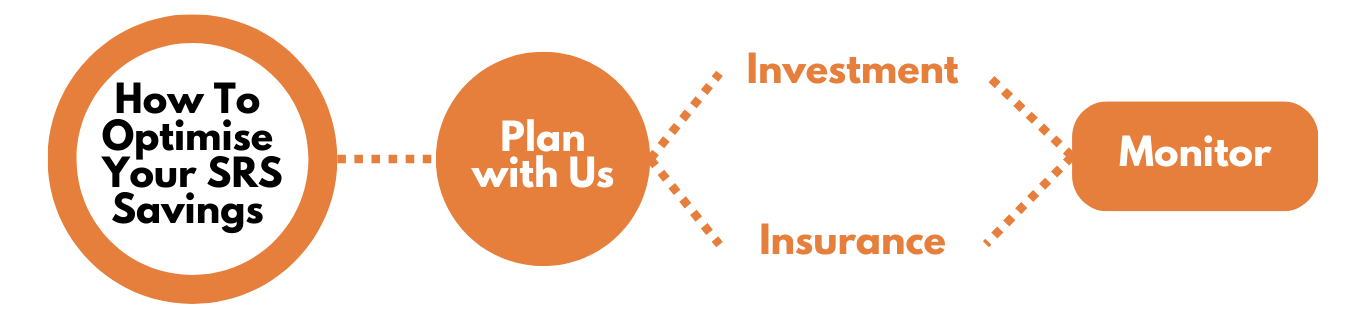

Depending on your objectives, there are multiple financial solutions to invest your SRS savings

20 approved products from 6 insurers

We have more than 1400 solutions, to suit your every needs

With over hundreds of financial solutions from 70 asset management companies and 6 insurance companies, we can help you to narrow down the options and optimise your SRS savings to suit your needs best.

(All information on investment and insurance products are correct as of 1 October 2023.)

Karen is a senior financial advisory manager with 29 years of experience. Since then she has helped nearly 500 families enhance their financial portfolios. Abiding by an ethos to take the time to understand her clients’ needs, dreams, aspirations and concerns, Karen methodically tailors solutions that are catered to each client.

Despite her years of on-field experience, Karen possesses the know-how and communicative skills to relay technical knowledge efficiently to clients of all ages, from Gen Zs to Retirees.

Karen’s personal philosophy is that learning never stops, and she is constantly seeking new knowledge and data-driven insights to ensure her advice is relevant and up to date. She is especially skilled at spotting potential financial challenges and helping her clients avoid costly mistakes. A sign of her expertise, Karen’s clients have testified to the value of her advice, particularly those who are planning for their futures.

A mother, spouse and daughter, Karen understands the importance of planning for the future, while anticipating potential challenges.

Let us assist you with all the calculations. Ride on an exciting investment journey with us!

Singapore's most progressive financial advisory firm with more than 20 years of excellence.

Financial Alliance is a leader in providing wealth advisory services to individuals and corporates alike, including private wealth advisory, Islamic wealth advisory and fee-based advisory.

We have been practising as Singapore's leading financial advisory firm for more than two decades.

Learn MoreWe work with dozens of product providers so our consultants can bring the most comprehensive solutions to clients.

Learn MoreWe are fully MAS-regulated so you always have peace of mind. Our track record speaks for itself.

Learn MoreBy definition, a FA firm is one that sells the products from more than one insurer or business partner.

However, you should consider whether the FA firm can ensure that financial advice given is free from the undue financial influence.

Ever since our founding more than two decades ago, Financial Alliance is committed to offer impartial and client-centric financial advice.

We have your best interest at heart and will leave you to make your decision.

If suitable and impartial financial advice is what you seek, then you should only engage a trusted FA firm.

At Financial Alliance, we are dedicated to offering our clients the best financial advice.