AIA Ultimate Critical Cover (UCC)

Allow yourself the space to restore, refuel and reset when recovering from critical illness.

Allow yourself the space to restore, refuel and reset when recovering from critical illness.

Footnotes

1. The current coverage amount will be reset to 100% of the coverage amount if the UCC policy is in force 12 months after the last critical illness claim.

2. Unlimited claims apply to major stage of critical illnesses. Only one claim is payable for each stage of a critical illness. The total amounts payable for all stages of a critical illness shall not exceed 100% of the coverage amount. Maximum claim limit of 500% of coverage amount applies to early and intermediate stage of critical illnesses.

3. Applicable for early and intermediate stage critical illnesses covered by UCC policy. The total amounts payable for the early and intermediate stage of the same critical illness shall not exceed S$350,000 per life combined across all the UCC policies covering the same insured.

4. The UCC policy will terminate after the death benefit or accidental death benefit is paid out.

5. Two-year waiting period applies. We will only admit a claim for Ultimate Relapse Critical Illness Condition if we have previously paid 100% of the coverage amount under the Critical Illness Benefit for any stage of the same critical illness.

6. This benefit is payable once and terminates thereafter.

Ensure you have the the ultimate critical illness protection needed for confidence and peace of mind. Act now to safeguard the future for you and your loved ones.

Buy Now

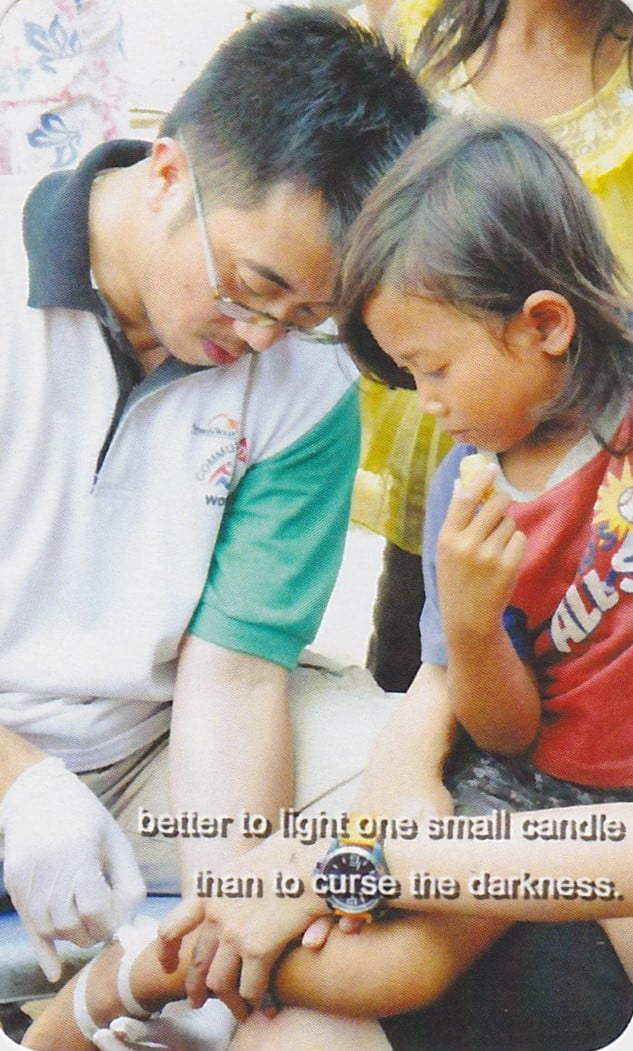

Since young, the dream of being a medical doctor has always been in my heart and following closely to my Secondary School mottoes – 礼义廉耻 忠孝仁爱 Courtesy, Righteousness, Integrity, Sense of Shame, Loyalty, Filial Piety, Humanity and Love, that mould my principles and attitude in life. However, life was endless challenge to me. Starting from my late elder brother going through 9 yrs of kidney failure then passing on at age or 30, then my beloved late maternal grandmother who struggled through 20 tormenting years of renal dialysis. In between was my mother who suffered 2 episodes of cancer and father’s business gotten into severe problems. Just like what the wise man’s words, if it did not kill you, it only make you stronger – exactly how I reminded myself to stay positive and engrained in myself that Integrity and Humanity are important aspects I hold tightly in my life along with other 6 values.

Initially, I was an Engineer in a Japanese Company and then after 13 months, I started my career in Financial Services with the objective of being a Financial Planner, instead of just being an Insurance Sales Agent.

I finally got my chance to walk away from the Insurance Industry when I was licensed by MAS to be a Financial Adviser Representative with Financial Alliance, Singapore’s largest Independent Financial Adviser (“IFA”). Now, I can truly render unbiased and genuine financial advice to my clients, friends and their loved ones.

In 2007, I met my mentor. He taught me what is true and genuine Client-Centric Financial Planning. I spent almost 7 years mastering this approach. With my wonderful mentor, I finally learned to be who I have always wanted to be – a Client-Centric Financial Planner.

“Sincere”, “Genuine”, “Honest” and “Helpful” are the common feedback I get from my friends after they have met up with me and later, engage my services to assist them in their Financial Well Being.

With the support of Singapore’s largest IFA Firm, I am able to provide the most comprehensive Financial Services catered to the needs of today’s consumers.

We work with Banks, Insurance Product Manufacturers, Wills & Trusts Companies, Fund Managers and Investment Platforms to address your various concerns throughout your life journey.

We do not replace your lawyer, accountant or anyone else. Instead, we work with them and ensure proper integration of your financial plans.

For a NON-Obligatory Exploratory Discussion (ED), do contact me at tc90056479@yahoo.com.sg.

By definition, a FA firm is one that sells the products from more than one insurer or business partner.

However, you should consider whether the FA firm can ensure that financial advice given is free from the undue financial influence.

Ever since our founding more than two decades ago, Financial Alliance is committed to offer impartial and client-centric financial advice.

We have your best interest at heart and will leave you to make your decision.

If suitable and impartial financial advice is what you seek, then you should only engage a trusted FA firm.

At Financial Alliance, we are dedicated to offering our clients the best financial advice.